How Tax Credits Work

Your charitable donations to bgc Riverview can help you earn meaningful tax credits on your next return. Here’s a breakdown of how tax credits work based on your taxable income.

For Annual Taxable Income of Less Than $200,000:

- First $200 of all charitable donations:

- 24.68% Tax Credit (9.68% provincial and 15% federal)

- Above $200 of all charitable gifts:

- 46.95% Tax Credit (17.95% provincial and 29% federal)

For Annual Taxable Income of More Than $200,000:

You may be eligible for additional tax credits. Please consult a financial advisor for more information.

Tax Receipts

Donations of $20 or more are eligible for a tax receipt. Gifts-in-kind with a receipt or proof of purchase or cost are also tax receiptable.

Contact Us for More Information:

If you would like to be added to or removed from our donor contact list, or if you have any questions about the donation process, please contact us at 506-387-7070.

Mailing Address for Donations

If you’d prefer to send your donation by cheque or money order, please mail it to:

BGC Riverview

50 Runneymeade Road

PO Box 7416

Riverview, New Brunswick

E1B 4T9

Charitable Registration #: 894505668RR0001

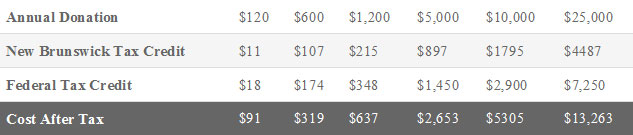

True Cost of Donating:

The table below shows the true cost of donating at various levels. The credits you receive will reduce your overall cost, making your gift even more impactful.

Disclaimer:

This information is general in nature and should not be considered legal or financial advice. BGC Riverview encourages you to seek professional legal, estate planning, and financial advice before making any decisions.